Simply put, Stamp Duty is payable when you buy shares and Stamp Duty Land Tax (SDLT) is payable when you purchase land or building. Since introduction of the higher rates of SDLT on 1 April 2016, evaluating the stamp duty land tax exposure on purchase of a second home or…

Expert Advice for Optimal Tax Efficiency. Receive trusted tax advice from our London-based firm for efficient management of trust and estate taxation, ensuring compliance and maximising tax benefits. Our expert team of tax advisors is here to provide you with comprehensive guidance and strategic solutions to navigate through the complex…

Our comprehensive income tax, capital gains tax, and inheritance planning services in the UK ensure compliance and maximised tax savings. Trust our experts to navigate the complexities seamlessly. We cater for both UK and Non-UK resident clients. Welcome to Spherical Accountants, your trusted partner for income tax, capital gains tax,…

Whether you are a UK or non-UK tax resident you are required to pay Capital Gains Tax on gains made from proceeds received from the sale of an asset. These assets include; land, property, shares and gifts. We make sure that rollover relief, entrepreneur relief, private residence relief, letting relief, gift relief and incorporation relief are claimed where applicable.

Your tax residency status determines whether and how you will be taxed on your UK and worldwide income.

You can automatically be a non-UK resident or automatically be a UK resident however, sometimes the situation is not as simple and clear.

We provide expert guidance on capital gains tax (CGT) implications related to the transfer of assets during divorce proceedings. Our team of experienced tax advisers in London understands the complexities of CGT laws and can help you navigate the tax implications of such transfers efficiently. We offer tailored solutions that…

Welcome to Spherical Accountants, your one-stop solution for comprehensive and expert Employment Tax services in the UK. Our dedicated team of tax consultants specialises in navigating the intricacies of employment-related tax obligations, ensuring compliance, and optimising tax benefits for both employees and employers. Why Choose Our Employment Tax Services Specialised…

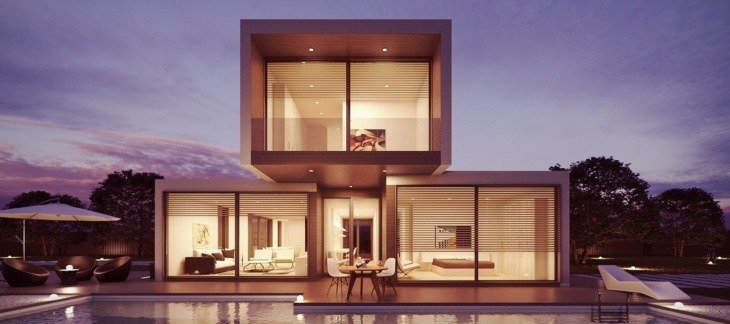

Welcome to our professional UK property tax services. Are you a property owner in the UK looking to optimise your tax position while complying with all legal requirements? Our dedicated team of property tax experts is here to assist you in navigating the complex world of real estate taxation. Whether…

Welcome to our premier self assessment tax return services. Are you struggling with your tax return? Worried about missing deadlines or making costly mistakes? Our team of experienced tax professionals are here to simplify the process for you. We understand that filing a UK tax return can be overwhelming, but…

Our team is up to date with rapidly changing tax legislation, qualified and experienced to deal with your business tax matters. When combined with our corporate tax advisory services, we will ensure that you are not paying more tax than you should. For example, we ensure that capital allowances are…

Suppose your business taxable revenue has reached the VAT registration threshold. In that case, you must file the VAT return using the MTD system, i.e. Making Tax Digital system. Making Tax Digital (MTD) is a system introduced by HMRC that has changed how the UK tax system works. From April…

Minimise tax liabilities and secure your legacy with assistance from Spherical Accountants. If you are planning to transfer your wealth to your loved ones during your lifetime or on your death, at Spherical Accountants, we specialise in Inheritance Tax planning designed to help you navigate the intricate landscape of wealth…